If you’ve tried to hire a trusted long distance moving company, chances are you’ve heard about moving insurance. Whether you are relocating to a nearby street or across the country, you want to be sure that your items are taken care of and as well have a backup plan in place, in the event of damage or loss.

To assist you in separating the rumor from vital facts, you should know how moving insurance works.

We’ve compiled an easy-to-use guide to explain what and what are involved in moving insurance. First, you need to know what moving insurance is.

What is Moving Insurance?

Moving insurance works similarly to auto insurance. Just like you can get into an accident regardless of how expert you are at driving, moving accidents also occur to even experienced professionals.

Moving insurance provides protection for your goods that get lost or damaged during the move. The details of the things covered in your insurance are based on your policy, but it can start from fires or floods to a mover dropping your brand new smart TV accidentally.

Moving companies can’t sell insurance technically, but with federal law, they are required to give valuation options. You can also purchase insurance from third-party providers which we will discuss later.

Below are the three unique options you have:

1. Released Value Protection

- Covers $0.60 per pound for items

- Doesn’t provide coverage for full market value

- Comes standard in moving plan

2. Full-Value Protection (FVP)

- Provides full coverage on all your shipment.

- Repairs broken items.

- Replaces broken item with the same one.

- Offers a cash reimbursement of the same amount to the item’s market value.

- Doesn’t provide cover for items of extraordinary value (over $100 per pound).

3. Third-Party Insurance

- Provides coverage for damage from natural disasters, such as floods, tornadoes, etc.

- Provide coverage for items of extraordinary value (over $100 per pound).

- Supplements value protection valuation.

What is Valuation?

When you are signing a moving agreement, you may notice different levels of liability or valuation coverage as popularly referred to, offered by the moving company.

Valuation coverage is just the quantity of liability that your moving company is willing to take in the event of damage or loss to your belongings during a move. Each level of liability dictates the amount the moving company will reimburse you if your belongings become lost or damaged while under their care.

However, these liability options only cover little. It is also necessary that you know that valuation coverage is different from insurance. A lot of people think moving insurance is just valuation coverage offered by their moving company.

What Are The Things Not Covered By Valuation Coverage?

Not all the items in the back of the moving truck will be covered by valuation coverage. For example, if anything happens to your shipment outside the control of the movers, there is a possibility that you won’t receive proper compensation.

A few other examples of what can restrict a moving company’s liability include:

- Packing your moving boxes yourself instead of hiring the company moving you to do it. The FMCSA says “if items you pack are damaged, it may be tough to file your claim against the moving company for the boxes packed by you”.

- Damaged to items caused by mother nature like hurricane, tornado, fire or earthquake.

- Not allowing your movers to know (in writing) about items of great value before moving.

- Not reporting loss or damage to belongings quickly after the move. Customers usually have nine months to submit a written claim but check your moving company for specifics.

Packing “dangerous, perishable, or hazardous materials in your household belonging without the knowledge of your movers” stated by the FMCSA.

What Are The Various Types Of Valuations Offered By Moving Companies?

All state-to-state movers are required by law to offer two options of liability to clients:

- Released Value Protection and

- Full Value Protection.

Below is a fast look into each:

Released Value Protection

This is also referred to as basic coverage, and it is a federal requirement for long-distance moving companies. Moving quotes issued by movers automatically have this coverage included, so it is not an extra cost.

Released value protection often provides $.60 per pound for lost belongings, which most people don’t find sufficient. The weight of a 50-inch TV is 35 pounds on average, which implies that released value protection will only provide $21 reimbursement if your TV gets damaged by movers.

This coverage is not valid if you pack your items yourself; you take responsibility by packing. Basic coverage is ideal for people moving locally with few expensive items or who is looking to save money.

- Who might go for basic coverage: A college student moving locally from their dorm room to their parent’s home for the summer might choose the released value protection if they don’t have much cash and don’t have expensive items to move.

Full Value Protection

This valuation type costs extra but offers more comprehensive coverage than the released coverage, but also, is not as extensive as insurance. With this coverage, movers are liable for the current market price of your household goods and will offer you three solutions should they break any of your items during a move:

- Repair the item

- Replace the stuff with a similar one

Offer a cash reimbursement of the same amount to the current market value of the broken item.

How Do I Know If The Valuation Is Offered By My Moving Company?

The federal law requires all moving companies to offer valuation options, with basic value protection in each moving package. All movers offer some kind of valuation policy, but to find out what a company offers, you will have to try out its website or call them.

What is 3rd Party Insurance?

Third-party insurance companies take care of moving insurances for moving companies since moving companies are not authorized insurance sellers. Third-party insurance ensures you can buy full-coverage, just from another provider.

For instance, if you’ve opted for the basic valuation to protect your move but want extra coverage, this is made possible by third-party insurance.

Since released protection covers just $0.60 per pound, third-party insurance can help make up the $0.40 gap to the amount.

Before you purchase third-party insurance, make sure you find out if your homeowners or renters insurance policy already provides you coverage.

Do i need to get Moving Insurance?

You need moving insurance if you are particular about the safety of your household belongings and want to protect them against loss or damage. Paying a little part of the total value of your item to protect yourself from the worst situation is worth it.

Free basic coverage is too small for some people. Try upgrading to full-valuation coverage or going for third-party insurance for belongings of great value.

What Does Moving Insurance Cover?

Remember that moving coverage is different from moving insurance. Moving companies offer moving coverage, and it is third-party insurance companies that offer moving insurance.

- Moving companies cover: Loss or damage that happen while belongings are in their care, up to a certain dollar amount.

- Third-party insurance covers: Damage resulting from actions beyond the movers’ control or that exceeds the liability limit.

What Does The Moving Company Not Cover?

Basic or full-value coverage from the movers doesn’t cover some things. If a mover is not involved with the belongings directly, the company is not liable for them. Such as:

- Items not packed by movers

- Natural disasters that destroy belongings

- Damage in storage not linked with the movers

On the contrary, third-party insurance covers belongings damaged under the circumstances mentioned.

Will My Existing Insurance Cover My Move?

Your homeowner’s insurance, renters insurance, or condominium insurance might cover part of your relocation. It is always nice to contact your policy provider to find out what is covered.

There are insurance providers that cover relocation in these ways:

- Coverage for shipment not at home

- Relocation insurance

- Trip transit insurance

- Total loss coverage

The major problem with move coverage with the use of the current insurance plan is that your future premium might rise if you file a claim.

What Is The Cost of Moving Insurance?

The cost of moving insurance is different based on the kind of coverage you buy and the details of the coverage.

- Released value protection: This is basic coverage and is almost often free. You just must ensure you sign it in your agreement.

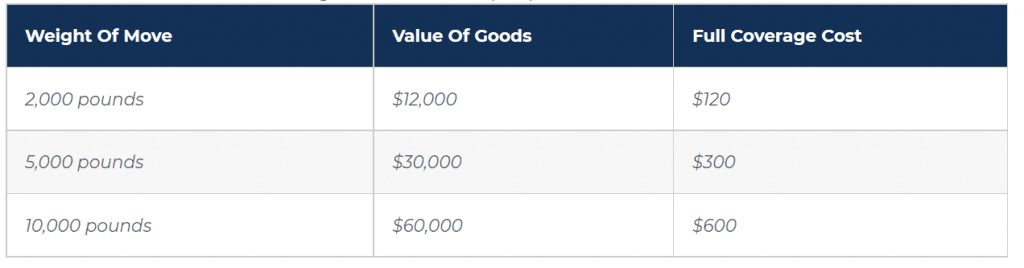

- Full value protection: This often costs 1% of the overall estimated value of your shipments. Below is how full-valuation protection costs are calculated:

- The movers find to determine the weight of the items. In this situation, we assume they weigh 5,000 pounds.

- The cost is normally 1% of the overall value. You pay 1% of $20,000, or $200,000 for coverage.

The estimated cost of full coverage, based on a $6 per pound valuation.

| Weight Of Move | Value Of Goods | Full Coverage Cost |

|---|---|---|

| 2,000 pounds | $12,000 | $120 |

| 5,000 pounds | $30,000 | $300 |

| 10,000 pounds | $60,000 | $600 |

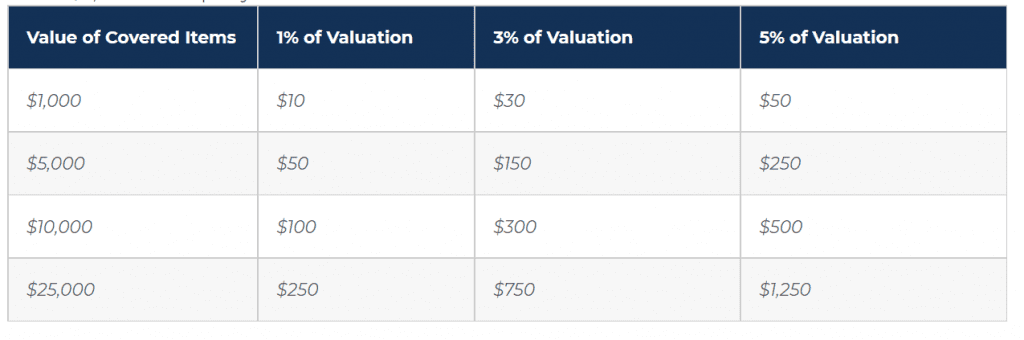

Third-party insurance: The cost of third-party insurance is different based on the company and policy, but prices start from 1% to 5% of the overall valuation. You would spend $150 at a 3% rate to insure items worth $5,000. Third-party insurance estimated costs.

| Value of Covered Items | 1% of Valuation | 3% of Valuation | 5% of Valuation |

|---|---|---|---|

| $1,000 | $10 | $30 | $50 |

| $5,000 | $50 | $150 | $250 |

| $10,000 | $100 | $300 | $500 |

| $25,000 | $250 | $750 | $1,250 |

Is My Move Covered by the Homeowner’s Policy?

If you assume that your entire household belongings will be covered by your homeowner’s insurance (or renters insurance), rethink it. I strongly recommend that you contact your insurance agent to ask about your actual policy, as they differ from each carrier.

MovingInsurance.com identifies that some homeowners’ insurance policies don’t provide coverage to belongings that are in some policies may only protect your belongings while they are being packed by the movers in your home.

How do I select the Kind of Valuation that is Right for Me?

Now that you know your option, how do you decide?

1. Find out how much your items are worth

Make a complete list of all your belonging (and try to video it on your smartphone), from pans to bookshelves to shoes. Ensure you add important details, such as existing damage.

Although it might be tough, listing out your belongings before moving can save you much stress and money in the process. As you list all your belongings, be sure to ask yourself some vital questions.

What is the actual market value of your dining set, living room chairs, and shoe collection? Do you have many uncommon or antiques or you have sentimental valuables in your home? Find out the dollar cost of your items and then determine the weight of your belongings.

Now, look into released value protection against full value protection. Which is the sensible option?

2. Do a little calculation to find out if released value protection is enough

Assume you estimate the overall weight of your belongings to 10,000 pounds. If you select released valuation coverage, your movers would assume the liability of $6,000 ($0.60 x 10,000 pounds). In general, if your overall items are worth $6,000 or less, it is financially reasonable for you to go with the released valuation coverage.

3. Choose if the extra cost of full value protection is worth it

Now, assuming the value of your household belongings is around $80,000, $6,000 worth of coverage would not even be enough to replace your antique art. In that situation, you may want to buy full-value protection.

Even if you make a $500 premium payment and have a $1,000 deductible, the cost will only be worth it if it is your $1,500 TV value that is damaged. Just ensure you know of any additional costs linked with obtaining coverage for items that worth above $100 per pound (items of high value).

There are also other factors to consider when choosing the right coverage for your need, such as the distance of your move and whether you are moving extraordinary valued items like designer shoes yourself.

Things to not forget when Buying Valuations

How you decide to protect your goods is your decision to make at the end of the day. Below are a few vital things not to forget as you proceed on the process:

- Moving insurance is different from insurance, but for all purposes and intents, acts similarly. They refer to it as valuation coverage.

- Released value protection is added in your moving quote so you don’t have to pay for it as extra but its protection is minimal ($.60).

- Full value protection is extensive but needs you to make an upfront premium payment (often 1% of the overall value).

- Full value protection doesn’t cover belongings of greater values automatically (over $100 per pounds items), you will have to pay an extra cost t cover such items.

The coverage type you select should be based on the level of value you have for your household belongings; do you have much valuable furniture or just some old ones from college you wouldn’t mind losing?

Are There Other Move Protection Tips For Me?

- Take photos of all items before moving. This will give you more evidence in case you have to submit a claim for damaged items.

- Carefully pack if you are doing it yourself, ensure you use the ideal boxes, packing materials and supplies, and protective materials to pack everything as securely as possible. Read Best Packing Checklist When Moving.

- Hire a trustworthy moving company with positive reviews. Need assistance getting one? The extensive network of reputable as well as reliable movers from Adams Van Lines makes it easy to find and reserve the best movers for the job. Adams Van Lines movers are licensed and insured, so you don’t have to panic as your move will be completed by good movers. Request for a quote today by clicking GET A QUOTE at the right corner.

Final Words

If you have enough budgets to accommodate supplemental moving coverage, we recommend it. Paying much cost to ensure all parts of your move is so much worth it. For people with valuable items that need extra coverage, buying insurance from a third-party company is a brilliant idea.

All movers offer two valuation types. They both can protect your household goods but to a limited level. If you want direct insurance, you will have to contact a third-party provider.